伦敦金分时线英文是什么

来源于:本站

发布日期:2025-09-25 09:05:20

### Understanding the London Gold Intraday Chart: A Guide for Every Trader

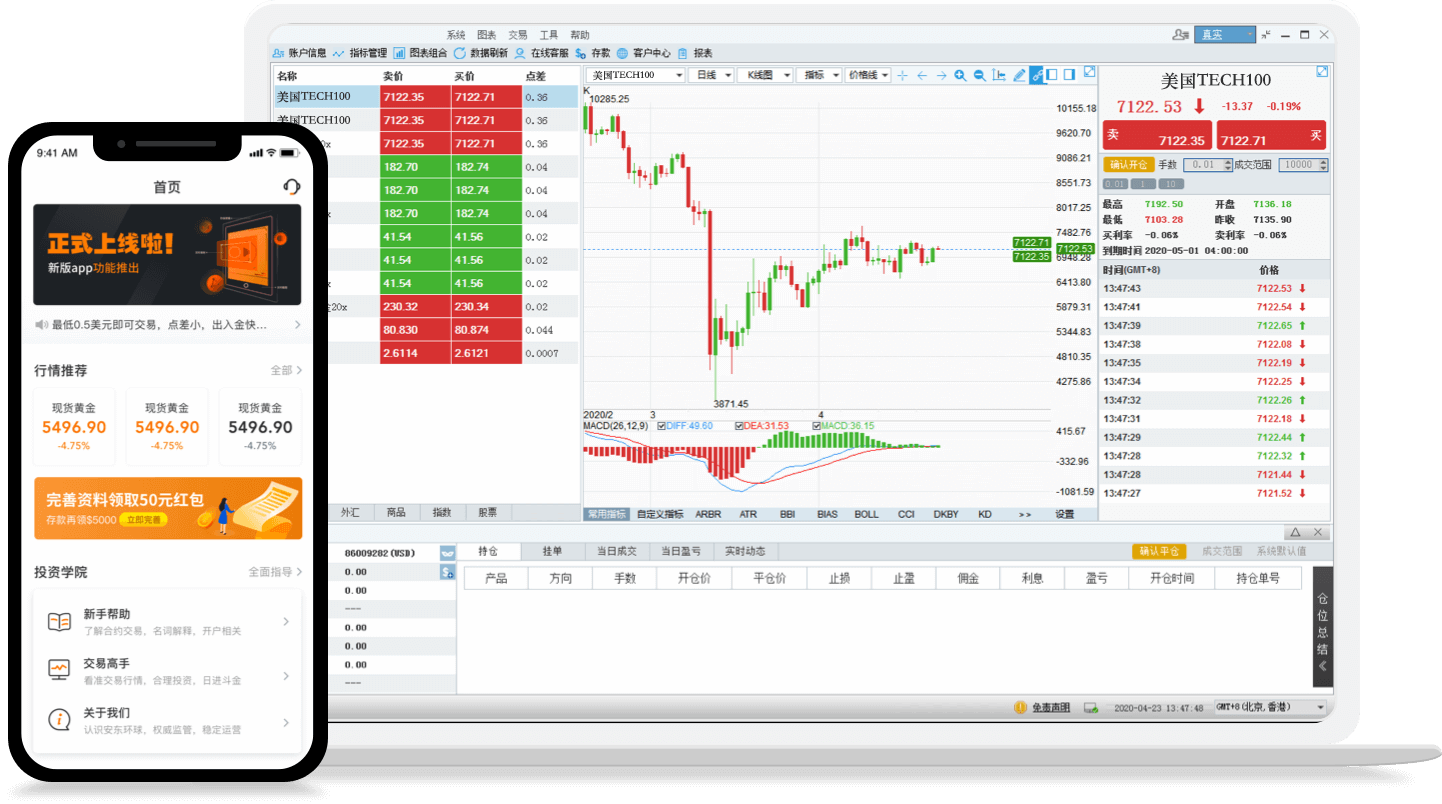

In the world of trading, especially when it comes to commodities like gold, having a solid grasp of market movements is essential. One of the best tools to achieve this is by analyzing the intraday chart, specifically for London Gold. This chart provides traders with insights into price fluctuations, trends, and potential entry or exit points. Let’s dive deeper into what the London Gold intraday chart is and how you can utilize it to enhance your trading strategy.

#### What is the London Gold Intraday Chart?

The London Gold intraday chart is a graphical representation of gold prices traded on the London market throughout a single trading day. This chart typically displays price movements in real-time, allowing traders to see how the market reacts to various factors such as economic news, geopolitical events, and market sentiment. The intraday chart can vary in time frames, commonly viewed in 1-minute, 5-minute, or hourly intervals, depending on the trader's strategy.

#### Why Focus on the London Market?

London is one of the world’s largest gold trading hubs, and its market influences gold prices globally. The London Bullion Market Association (LBMA) plays a crucial role in setting the benchmark for gold prices, which is crucial for traders worldwide. By focusing on the London Gold intraday chart, you gain access to a wealth of information that can help you make informed trading decisions.

#### Key Components of the Chart

1. **Price Movements**: The primary function of the chart is to display the price movements of gold. Traders look for patterns, such as support and resistance levels, to identify potential trading opportunities.

2. **Volume**: Understanding trading volume is essential. Higher volumes often indicate stronger price movements and can validate the strength of a trend. Conversely, low volume may suggest a lack of conviction in price movements.

3. **Technical Indicators**: Many traders incorporate technical indicators, such as moving averages, Relative Strength Index (RSI), or Bollinger Bands, into their analysis. These tools can help identify overbought or oversold conditions, making it easier to determine entry and exit points.

4. **Time Frames**: Different time frames can yield different insights. Shorter time frames can show immediate market reactions, while longer time frames may highlight broader trends.

#### Strategies for Trading Gold Using the Intraday Chart

1. **Scalping**: This strategy involves making small profits from minor price changes. Traders using the intraday chart can enter and exit trades quickly, capitalizing on small price movements.

2. **Day Trading**: For traders who prefer to open and close positions within the same day, the intraday chart is invaluable. It provides real-time data, allowing traders to react quickly to market changes.

3. **Trend Following**: By analyzing the chart, traders can identify upward or downward trends and align their trades with these movements. Entering a trade in the direction of the trend can increase the likelihood of profit.

4. **Risk Management**: Regardless of the strategy, managing risk is crucial. Setting stop-loss orders based on the chart’s support and resistance levels can help limit potential losses.

#### Conclusion

The London Gold intraday chart is an essential tool for any trader looking to navigate the gold market effectively. By understanding its components and applying relevant strategies, you can enhance your trading decisions and potentially increase your profitability. Remember, successful trading is not just about following trends but also about staying disciplined and informed. As you embark on your trading journey, keep an eye on the London Gold intraday chart and let it guide you through the complexities of the market. Happy trading!

温馨提示:本站所有文章来源于网络整理,目的在于知识了解,文章内容与本网站立场无关,不对您构成任何投资操作,风险 自担。本站不保证该信息(包括但不限于文字、数据、图表)全部或者部分内容的准确性、真实性、完整性、原创性。相关信 息并未经过本网站证实。

文章标签: 无

分享到

伦敦金投资

带您了解伦敦金怎么投资开户流程、操作技巧、交易策略知识,哪个平台投资门槛低/资金安全/口碑比较好?欢迎来美建金业!

2026-02-18

2026-02-18

2026-02-18

2026-02-18

2026-02-18

2026-02-18

2026-02-18

2026-02-18

2026-02-18

2026-02-17

2026-02-17

2026-02-17

热门排行

栏目热文

- 2 一手伦敦金要多少手续费

- 3 黄金td好还是伦敦金好

- 4 伦敦金收取过夜费的原因

- 5 伦敦金点差300是多少

- 6 伦敦金凌晨3点波动大不

- 7 伦敦金的指标哪个最好用

- 8 伦敦金怎样计算每克价钱

- 9 伦敦金交易平台怎么盈利

- 10 伦敦金的价格是什么意思