炒原油黄金白银英文单词

来源于:本站

发布日期:2024-12-13 06:54:17

### The Allure of Trading Oil, Gold, and Silver: A Journey into Precious Commodities

In the ever-evolving landscape of financial markets, trading commodities like oil, gold, and silver has become a captivating venture for many investors. The allure of these precious resources lies not only in their intrinsic value but also in the opportunities they present for profit. As we delve into this world, let’s explore the dynamics of trading these commodities and why they hold such a significant place in the hearts of traders and investors alike.

#### Understanding the Fundamentals

Before diving into trading, it’s essential to grasp the fundamentals of these commodities. Crude oil, often referred to as "black gold," is a crucial energy source that drives global economies. Its price is influenced by various factors such as geopolitical tensions, supply and demand fluctuations, and OPEC decisions. Understanding these factors can provide traders with insights into potential price movements.

Gold, on the other hand, is often viewed as a safe-haven asset. During times of economic uncertainty or inflation, investors flock to gold as a way to preserve wealth. The relationship between gold prices and currency strength, particularly the US dollar, is another critical aspect to consider. A weaker dollar often leads to higher gold prices, making it an attractive option for investors looking to hedge against currency fluctuations.

Silver, often dubbed "the poor man's gold," is a versatile commodity with both investment and industrial applications. Its price tends to be more volatile than gold, making it an attractive option for traders looking for quick gains. The demand for silver in industries such as electronics and solar energy can significantly impact its price, adding another layer of complexity to trading strategies.

#### The Trading Landscape

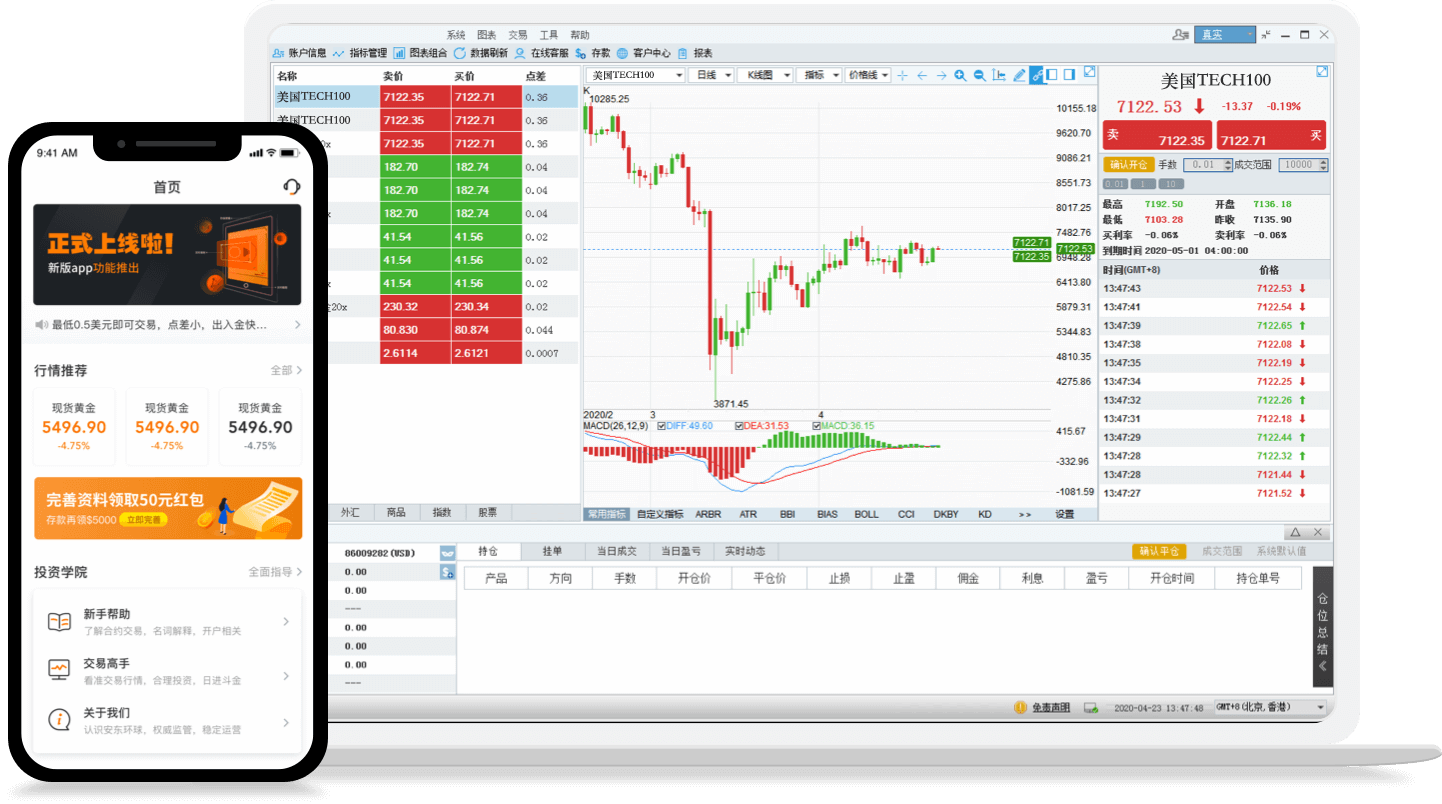

In recent years, the rise of online trading platforms has democratized access to commodities trading. No longer confined to institutional investors or wealthy individuals, anyone with an internet connection can participate in the market. This accessibility has led to a surge in retail traders, each hoping to capitalize on the price movements of oil, gold, and silver.

For those new to trading, it’s crucial to approach the market with a well-defined strategy. Day trading, swing trading, and long-term investing are all viable options, each with its own risks and rewards. Day trading requires quick decision-making and a keen understanding of market trends, while swing trading allows for more flexibility in holding positions over days or weeks. Long-term investing, on the other hand, focuses on the fundamental value of commodities and their potential for appreciation over time.

#### Analyzing Market Trends

Successful trading relies heavily on market analysis. Technical analysis, which involves studying price charts and patterns, can help traders identify potential entry and exit points. Indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands are popular tools used to gauge market sentiment and potential price movements.

Fundamental analysis, on the other hand, delves into the economic indicators that influence commodity prices. For instance, understanding the impact of inventory reports on oil prices or monitoring inflation rates can provide valuable insights for traders. Keeping abreast of global news, economic data releases, and market sentiment is essential for making informed trading decisions.

#### Risk Management

While the potential for profit in trading commodities is enticing, it’s equally important to acknowledge the risks involved. The volatility of oil, gold, and silver prices can lead to significant losses if not managed properly. Effective risk management strategies, such as setting stop-loss orders and diversifying one’s portfolio, can help mitigate these risks.

Traders should also be mindful of their emotional responses to market movements. Fear and greed can cloud judgment, leading to impulsive decisions that may not align with one’s trading strategy. Developing a disciplined approach to trading, including sticking to a predetermined plan and learning from past mistakes, is crucial for long-term success.

#### Conclusion

Trading oil, gold, and silver offers a fascinating glimpse into the world of commodities and finance. Whether you’re motivated by the thrill of short-term gains or the stability of long-term investments, understanding the intricacies of these markets can significantly enhance your trading experience. As you embark on this journey, remember that knowledge, strategy, and discipline are your best allies. Embrace the challenges and rewards that come with trading, and you may find that the world of commodities is not just a market, but a pathway to financial empowerment.

温馨提示:本站所有文章来源于网络整理,目的在于知识了解,文章内容与本网站立场无关,不对您构成任何投资操作,风险 自担。本站不保证该信息(包括但不限于文字、数据、图表)全部或者部分内容的准确性、真实性、完整性、原创性。相关信 息并未经过本网站证实。

文章标签: 无

分享到

黄金投资

了解黄金投资入门技巧与投资方式,美建金业可靠贵金属平台值得信赖!

2025-05-17

2025-05-17

2025-05-17

2025-05-17

2025-05-17

2025-05-17

2025-05-16

2025-05-16

2025-05-16

2025-05-16

2025-05-16

2025-05-16

热门排行

栏目热文

- 2 伦敦金投资app哪个好

- 3 伦敦金走势盘整有哪几种

- 4 黄金延期和伦敦金哪个好

- 5 十亿身家伦敦金教父传奇

- 6 伦敦金北京时间交易时间

- 7 伦敦金超短线5分钟刷单

- 8 黄金指数就是伦敦金指数

- 9 伦敦金市下午收盘价查询

- 10 开通伦敦金需要多少资金